unified estate tax credit 2021

How Might the Biden Administration Affect the Unified Tax Credit. Currently you can give any number of people up to 16000 each in a single year without incurring a taxable gift 32000 for spouses splitting giftsup from 15000 for 2021.

New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person.

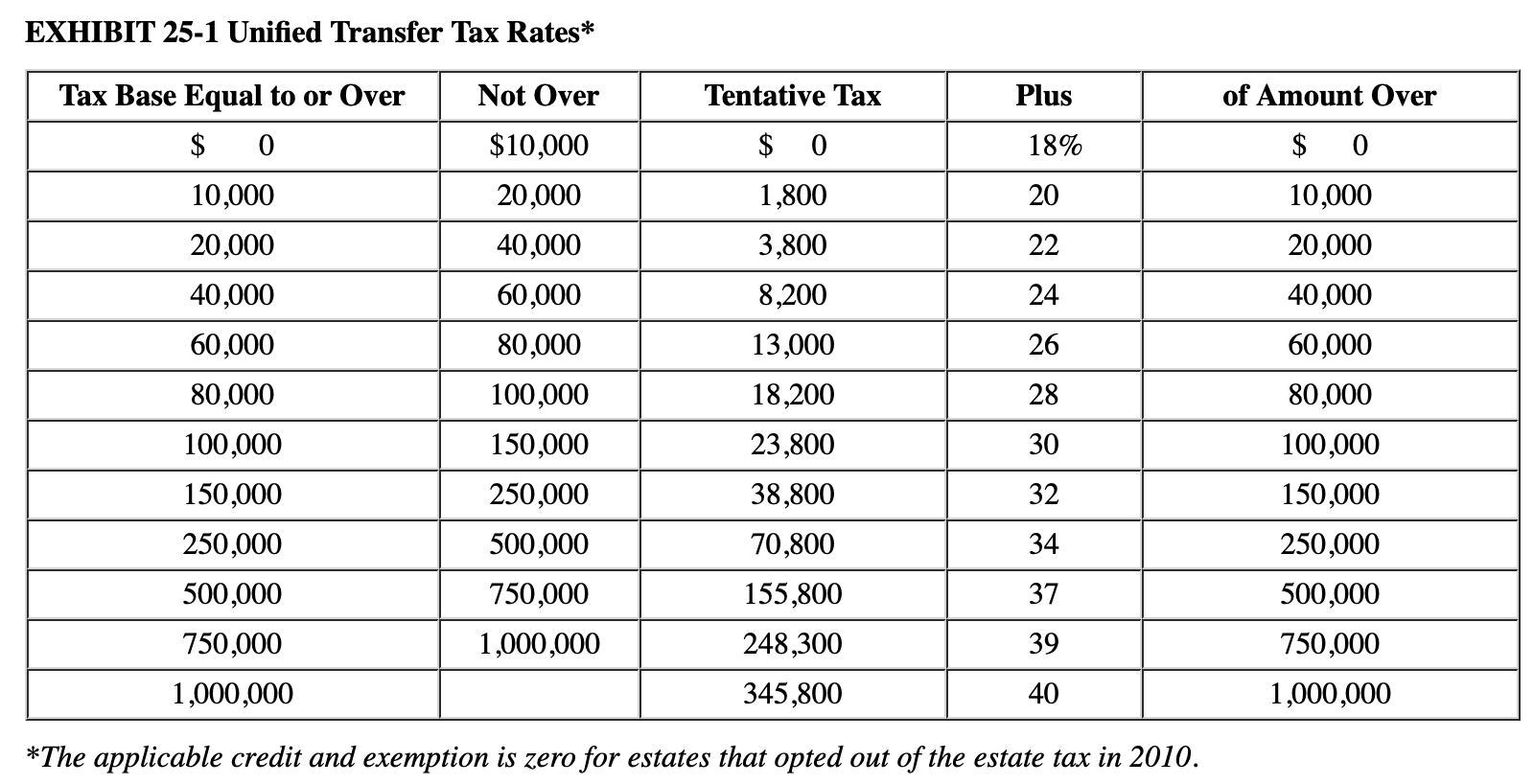

. This is called the unified credit After the unified credit limit is reached the donor pays up to 40 percent on that exceeding the unified credit. The previous limit for 2020 was 1158 million. Which will then be subtracted from unified credit unless the gift tax is paid in the year it is incurred.

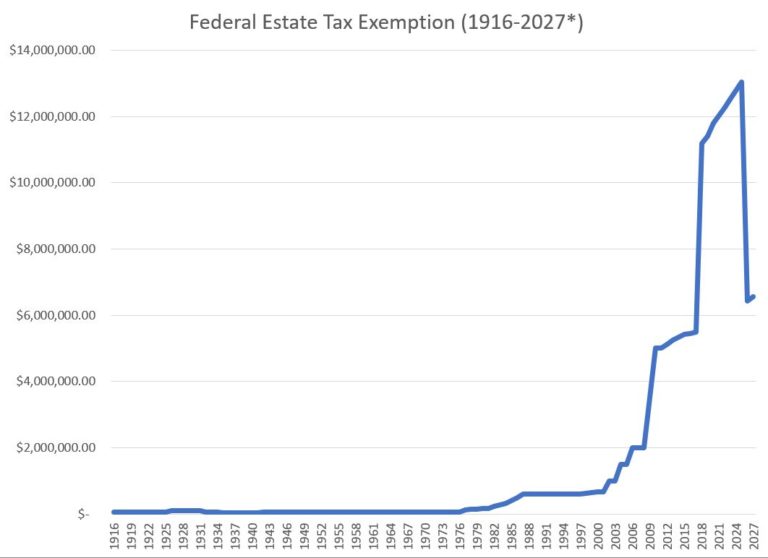

The clear trend in the past 20 years has been to increase the exemption and decrease the tax rate. Or of course you can use the unified tax credit to do a little bit of both. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them.

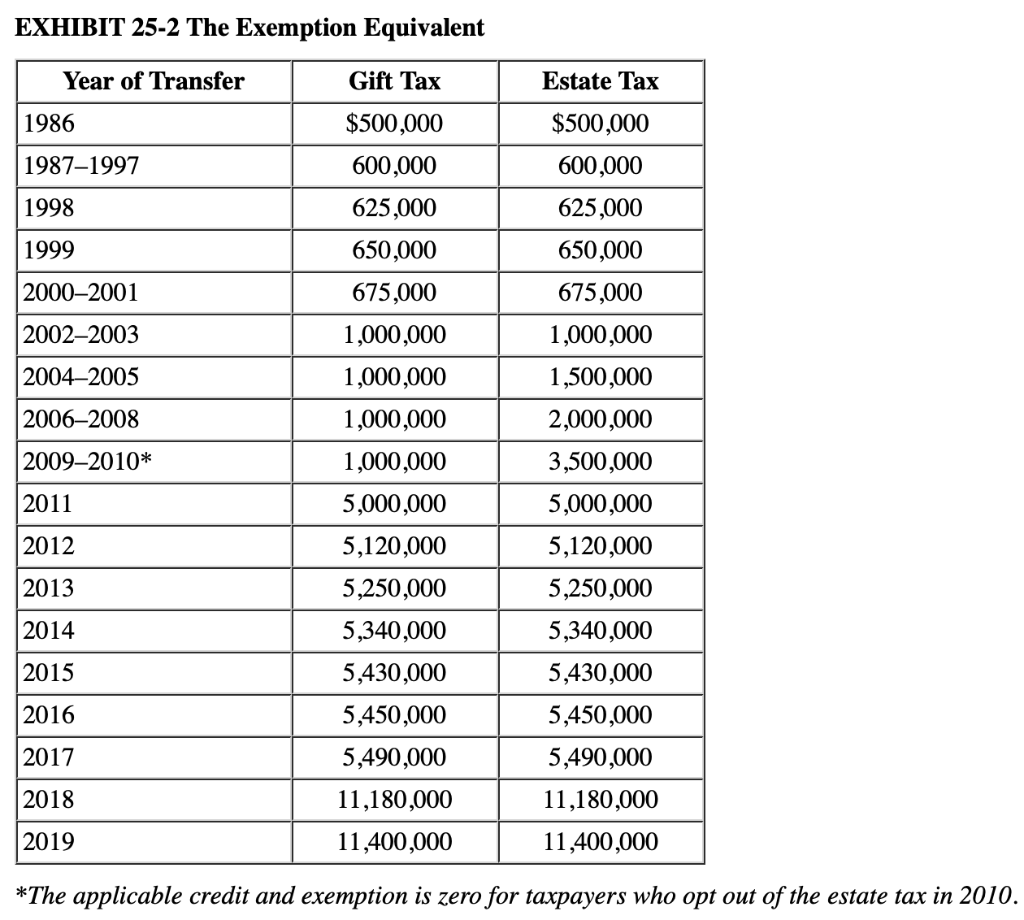

In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. The person receiving the inheritancegift receives the full 117 million with an additional 600000 left. The exclusion amount in 2021 increased to 11700000.

The unified tax credit changes regularly depending on regulations related to estate and gift taxes. The 117 million exception in 2021 is set to expire in 2025. Max refund is guaranteed and 100 accurate.

This means that the federal tax law applies the estate tax to any amount above 1158 million for individuals and 2316 million for married couples. Ad File State And Federal For Free With TurboTax Free Edition. It will then be taken as a credit against any estate tax owed.

The Unified Tax Credit exempts 117 million. A key component of this exclusion is the basic exclusion amount BEA. Free means free and IRS e-file is included.

Learn More At AARP. Start Your Tax Return Today. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF.

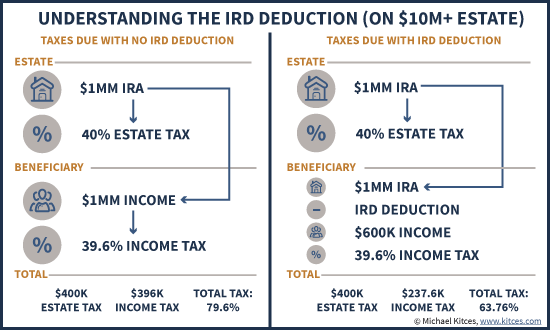

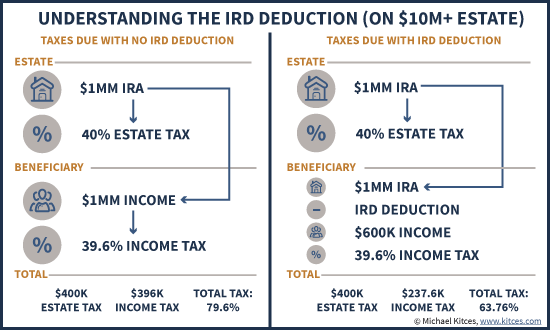

That 1 million is taxed at a rate of 40 percent 400000. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. The filing requirement for Estate Tax can vary depending on the year of death.

For 2021 that lifetime exemption amount is 117 million. The gift and estate tax exemptions were doubled in 2017 so the unified credit currently sits at 117 million per person. What Is the Unified Tax Credit Amount for 2021.

The Estate Tax is a tax on your right to transfer property at your death. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Review your cookie information for more details.

The recipient typically owes no taxes and doesnt have. In addition any portion of the unified credit that is unused can be used as an amount to be passed to a. This means that an individual is currently permitted to leave up to 117 million to heirs without any federal or estate gift taxes being applied.

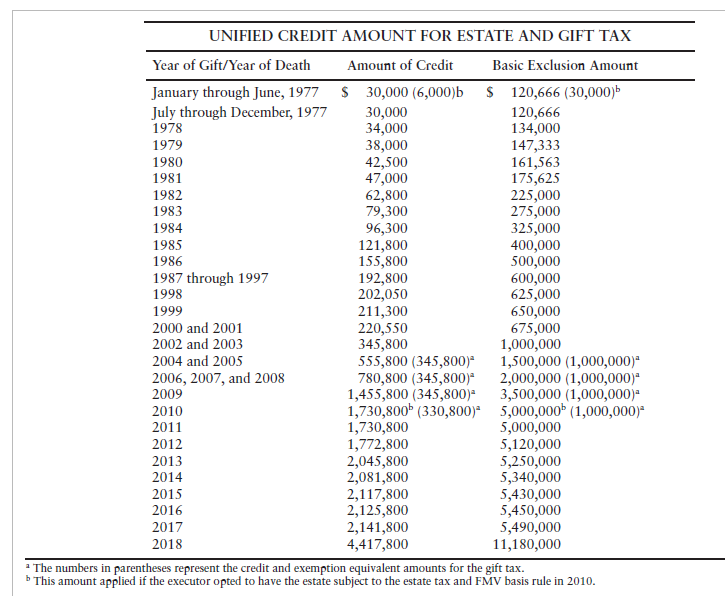

Any tax due is determined after applying a credit based on an applicable exclusion amount. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. The following table shows the trend.

By clicking accept you are agreeing to our use of cookies. This site uses cookies. There are differences for Minnesota requirements and Federal requirements.

That leaves 1 million above the exemption. Minnesota Filing Requirements Federal Filing Requirements Contact Info Email Contact form Phone 651-556-3075 Hours Address. Ad All Major Tax Situations Are Supported for Free.

The Ird Deduction Inherited Ira Beneficiaries Often Miss

How To Gift Assets Before The Pending Biden Tax Plan

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

What Are Estate Taxes And How Will They Affect Me Wallstreet Siteonwp Cloud

It May Be Time To Start Worrying About The Estate Tax The New York Times

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

A Taxing Matter For Family Businesses Mercer Capital

Top Ten Estate Planning And Estate Tax Developments Of 2021 The American College Of Trust And Estate Counsel

Solved Roland Had A Taxable Estate Of 15 5 Million When He Chegg Com

New Estate And Gift Tax Laws For 2022 Youtube

Solved Roland Had A Taxable Estate Of 15 5 Million When He Chegg Com

Will It Or Wont It Newest Reconciliation Bill Lacks Major Estate Tax Law Changes

Solved Required Information The Following Information Chegg Com